OneTrueKirk

Ethereum, cryptoeconomics, governance

Automated Teller Machine Machine

sic. exploring cross layer liquidity management

Objective

Allow users who currently have funds on rollups of varying degrees of decentralization like Arbitrum or Optimism, as well as sidechains like Polygon PoS, to enter the Credit Savings Rate at low cost and minimize latency risks.

Concerns

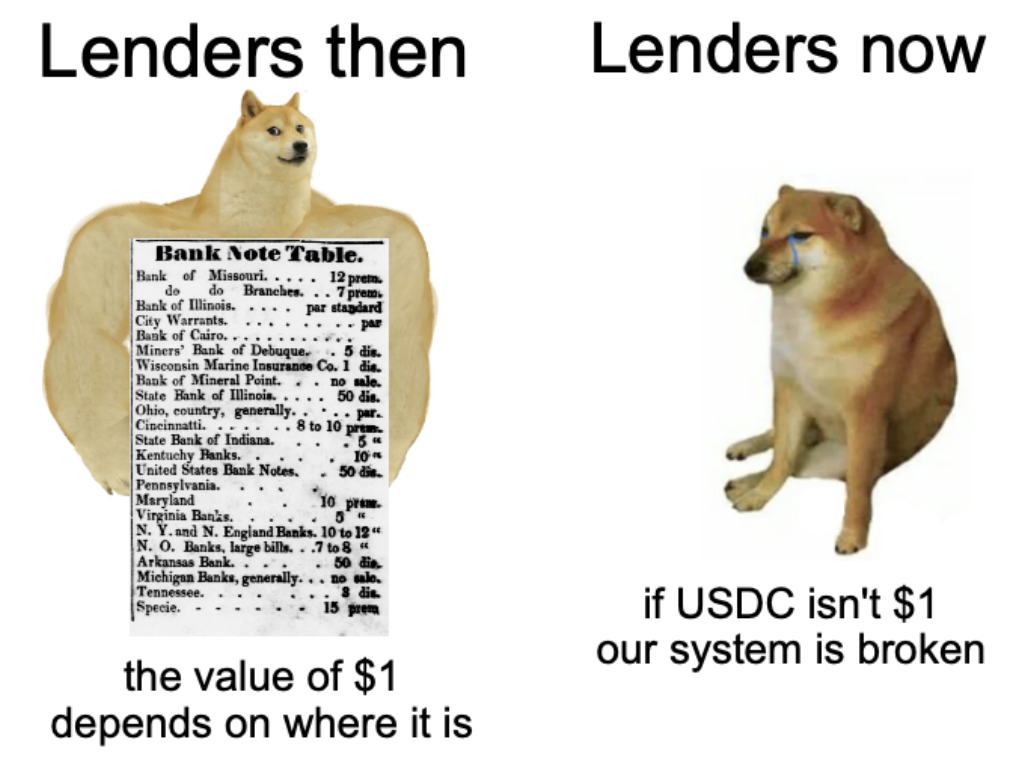

Any liquidity solution with a passive quoted price faces adverse selection in the event of bad debt. This is the main argument against a simpler system where a wrapped CREDIT token is exported to various L2s. If large amounts of passive AMM liquidity are needed to make the token accessible for users, the liquidity providers are exposed in the case of bad debt.

Iff a debt token is exported to L2, it may cause price instability when borrowers wish to close their positions on L1 but some of the supply is subject to a bridging delay.

Mechanism

One possible solution is the CreditATM. Users can deposit an external asset on L2, receiving a pool share receipt in exchange. On L1, CREDIT borrowers or arbitrageurs can trigger an auction and swap CREDIT for lenders’ stablecoins, or vice versa. There is no predefined target effective interest rate or utilization of the liquidity in the pool, rather, these are determined by the market.

A CreditATM has the following mechanisms accessible on L2:

- track a share price based on deposits and reported yield

- deposit an external asset, let’s say USDC, and mint a deposit receipt

dUSDCbased on the current share price - burn

dUSDCand receive USDC, but not atomically, as this would expose users to adverse selection in the event of bad debt originating on L1 that has not yet been marked down on L2. Instead, those wishing to access liquidity in either direction must trigger a “request for liquidity auction”, similar to a liquidation except no one is being penalized. The duration is such that it exceeds any potentially in-progress auctions on L1 that a user would attempt to frontrun, but is modest compared to a rollup withdraw delay - bridge

dUSDCto mainnet - send USDC to the mainnet

CreditATM(only the mainnetCreditATMcan call this function) - receive USDC from the mainnet

CreditATM(same as above) - report yield or loss (same as above)

On L1, a parallel contract has the following mechanisms and properties:

- track a share price based on deposits and reported yield

- allow users to swap USDC and CREDIT, but not atomically, as this would expose L2 users to adverse selection in the event of bad debt originating on L1. Instead, those wishing to access liquidity in either direction must trigger a “request for liquidity auction”, similar to a liquidation except no one is being penalized. It is anticipated that borrowers will be the primary users on L1, and savers the primary users on L2

- if the auction is to sell CREDIT, pull USDC from the L2

CreditATMbased on the auction results. If the auction is to buy CREDIT, send USDC to L2 based on the results - any CREDIT deposited in the

CreditATMis earning the savings rate - report earnings to L2, including savings yield and swaps yield (small tip for keeper on this), since the last time a swap occurred

- burn

dUSDCand receive CREDIT

Example usage

100 different people deposit a total of 1m USDC into a CreditATM on Arbitrum. Their experience is similar to depositing on Compound and minting a cToken – they mint right away and pay no fees, but push down the yield in the market they enter since there is now 1m in idle capital.

A borrower deposits $2m of stETH collateral on mainnet and mints $1m CREDIT at 4.1% interest before requesting a swap for USDC at the mainnet ATM. From a starting price of $0.50 per CREDIT, the ATM price increases to a limit of 1:1 exchange until this borrower fills their order at a 0.01% swap fee, meaning they sell their $1m face value of CREDIT for 999,900 USDC. The CREDIT is automatically deposited in the CREDIT savings rate and the holders on Arbitrum begin earning interest.

The CREDIT savings rate is yielding 4%, and depositors earn for three months.

Then, a different borrower wants to repay their loan. They initiate an auction in the other direction, where the ATM initially offers CREDIT tokens for $2 for every $1 face value, and gradually decrements the price. The second borrow is in a hurry to avoid liquidation and so might have been willing to get a better deal, but end up closing at a 0.25% fee. They pay 1,002,500 USDC for the $1m CREDIT deposited by the previous borrower, and close their position.

The ATM started off with 1m USDC, and now has 1.0026m USDC, plus 10,000 CREDIT earned from the CREDIT savings rate.

Wait, it’s all bridging?

The CreditATM is an opinionated bridge that keeps all idle USDC (or other deposit stablecoin, like DAI) on whichever layer users deposit it on, while making it available to CREDIT minters or arbitrageurs. Borrowers or arbitrageurs decide when it is worthwhile to take on the time and costs of accessing liquidity from L2.

They may not be separate contracts, but there should be separate accounting for each asset that is available to swap for CREDIT. This mechanism is PSM-like, but cannot be used to mint CREDIT, only to buy or sell according to borrower demand.

Liquidity and Yield Considerations

The CreditATM does not express an opinion about whether it should be holding the underlying asset, such as USDC, or CREDIT, instead this is driven by borrower demand vs depositor demand. When the CREDIT supply is expanding due to high borrower demand, it will tend to have its liquidity quickly absorbed and earn near the full CREDIT savings rate. When the CREDIT supply is contracting, liquidity will be returned to the CreditATMs and their yield decline. If there is high turnover in borrower positions, there may be significant swaps yield from competitive bidding in the liquidity auction.

The premise of a CreditATM on L2 is that users enjoy a low transaction cost, and don’t face an undue burden performing actions like withdrawing from the ATM when the yield is lower than their preference and depositing in another venue, or vice versa. This could be automated separately, or the base CreditATM could be extended to use a yield bearing deposit asset.

If there is inadequate USDC in the ATM to support withdrawals, it’s possible to sell dUSDC on a market. This leaves flexibility for users to manage their own liquidity needs. In the worst case, users or arbitrageurs can bridge dUSDC back to mainnet, redeem it for CREDIT, and call loans directly.

Conclusion

Previously, we considered the idea of “swaps terms”, like a normal lending term but with 1:1 exchange and no particular owner of the collateral. I’ve come to see the ATM model as better for managing liquidity, while lending terms are used for yield bearing or volatile collateral assets with willing outside minters. Users can provide liquidity using any asset of their choice, without it being necessary to mint CREDIT against that asset, and thus expose the system to the full risk of that asset at a low collateral ratio, or else accept efficiency losses by requiring high collateralization.

Unlike a Compound cToken that targets a specific percentage of idle liquidity to facilitate smooth withdrawals, the ATM simply provides an optimized venue for people to buy CREDIT and enter the savings rate, or vice versa. There is no explicit fee management intended to control utilization or reserves percentages. Naturally, we’d expect net borrower demand to be a random walk, sometimes being positive and sometimes negative. It’s possible that a more active liquidity strategy (ie, buying or selling at specific distances from peg only) can perform better, but it can also perform worse. When compared to buying their CREDIT on an AMM and staking on their own, depositing in the ATM presents a simple “no-loss” (due to swap fees, at least) strategy for passive lenders and is easily deployed to any layer. A lender can then utilize signed messages and other automation tools to schedule a withdraw for as soon as liquidity becomes available, without needing to pay an AMM swap fee.

A PSM or cToken has desirable liquidity properties from a certin perspective (mint 1:1 on demand), but is exposed to the risk of bank runs and bad debt. An ATM is based on external user deposits and conducts liquidity auctions to confirm any exchanges are at market price. Tldr; atomic composability is dead, long live asynchronous composability.